Quotex India

Quotex India is a rapidly growing online trading platform that offers a variety of financial instruments to its users. It provides a dependable and easy-to-use platform for trading in binary options, forex, cryptocurrencies, and other assets. Quotex India prioritizes user security and confidentiality, complying with rigorous regulatory standards. The platform has become popular due to its user-friendly interface, comprehensive educational resources, and efficient customer service. It serves both beginner and seasoned traders, offering a wide range of opportunities to diversify their trading portfolio and enhance their earnings. The platform is regularly updated with new features, providing Indian traders with the most sophisticated trading tools and technologies. In this Quotex review India, we will delve into more details about the broker’s features, benefits, and more.

How to Get Started with Quotex India

- Register: Visit the Quotex official website. Look for the ‘Sign Up’ or ‘Register’ button usually located at the top right corner. Click on it and you will be redirected to a page where you need to fill in some basic information like your email address or phone number.

- Verification Process: After registration, you will need to verify your identity. This process may vary depending on your country, but typically you will need to provide a scanned copy of your government-issued ID or passport, and sometimes proof of residence like a utility bill.

- Deposit Funds: Once your account is verified, you can deposit funds into your Quotex account. You can choose from various payment methods, including credit/debit cards, e-wallets like Skrill or Neteller, or cryptocurrencies. Make sure to check if there are any fees associated with the payment method you choose.

- Start Trading: Now you’re ready to start trading. Take some time to familiarize yourself with the platform and its features. Start by making small trades until you gain confidence and an understanding of how things work.

- Learn and Practice: Quotex also provides educational resources and a demo account where you can practice trading without risking real money. Make use of these tools to improve your trading skills.

- Keep Updated: Stay updated with market trends and news that might affect your trading. Quotex provides market analysis and news updates that can help you make informed trading decisions.

- Withdraw Funds: Once you start earning profits, you can withdraw your funds. The process is usually straightforward. However, it’s important to note that withdrawal methods and fees may vary.

- Get Support: If you encounter any issues or have questions, don’t hesitate to reach out to Quotex’s customer support. They can assist you with any concerns related to your account or trading.

Verification Requirements for Quotex India

- Identity Verification: This includes providing a government-issued ID like a passport, driver’s license, or voter’s ID. The ID should display your full name, date of birth, and picture.

- Address: You may be asked to provide a utility bill, bank statement, or any other official document that clearly states your address. The document should not be older than 3 months.

- Email Verification: Quotex India may send a verification link to your email. You will need to click the link to verify your email address.

- Phone Verification: You may be asked to provide a valid phone number. Then, a verification code will be sent to this number, and you will need to input this code on the Quotex India platform to verify your phone number.

- Financial Statements: Quotex may require proof of income. This can be in the form of bank statements, payslips, or tax returns.

- Card Verification: If you plan to make deposits or withdrawals using a credit or debit card, you may be asked to provide a copy of the front and back of the card. For security, you can hide some of the digits of your card number.

Remember, all the documents should be valid, clear, and easily readable. Any discrepancies or fraudulent activities can lead to the account being blocked.

Also, the verification process is in place to ensure a safe and secure trading environment. All users must complete this process to use Quotex India’s services.

Quotex Account Types

Quotex offers three different types of accounts to cater to various trading needs and financial capabilities of traders.

- Standard Account: The Standard Account is the most basic account type, suitable for beginners or those who want to start trading with a smaller investment. The minimum deposit required to open a Standard Account is just $10. This makes it a low-risk option for newcomers to the trading world who may not want to commit a large amount of money upfront. Traders with a Standard Account have access to all basic trading features and tools.

- Pro Account: The Pro Account is aimed at more experienced traders and requires a minimum deposit of $1000. This higher deposit limit means that the Pro Account is better suited to those who are confident in their trading abilities and are willing to invest more money. In return, Pro Account holders may enjoy additional features and benefits not available to Standard Account holders, such as advanced trading tools, priority customer service, and potentially lower transaction costs.

- VIP Account: The VIP Account is the highest level of account available and is designed for professional traders who are ready to commit a substantial amount of money to their trading activities. The minimum deposit for a VIP Account is $5000. VIP Account holders are likely to have access to the full range of Quotex’s services and features, including premium trading tools, personalized customer service, and more. They may also receive additional perks such as higher transaction limits or lower fees.

Quotex Demo Account

The Quotex demo account offers a plethora of features designed to aid new traders in familiarizing themselves with the platform and practicing trading strategies. The account is equipped with virtual funds, allowing users to simulate real trading without risking real money. It mirrors the live trading environment, presenting the same tools, charts, and assets as a real account. This includes access to a wide range of markets, including Forex, commodities, stocks, and indices. With the demo account, users can also access educational resources to improve their trading skills. This feature-rich demo account is an invaluable tool for beginners to gain trading experience and for seasoned traders to test new strategies.

Islamic Account

The Quotex Islamic Account is a special trading account designed to comply with the Islamic principles of finance. This account is built on the concept of Halal trading, which is free from Riba (interest) and adheres to the principles of Islamic Sharia law. It ensures that the trading operations do not involve any kind of interest, hidden fees, or commissions, which is strictly prohibited in Islam. This makes it a suitable option for Muslim traders in India who want to engage in online trading while staying within the bounds of their religious beliefs. The Quotex Islamic Account provides the same features and opportunities as conventional trading accounts but without any non-compliant elements.

Available Financial Instruments

Quotex trading platform offers a variety of financial instruments for investors to trade. Here are some of the available financial instruments on Quotex:

- Binary Options: This is the main financial instrument offered by Quotex broker. Binary options are a type of options contract in which the payout depends entirely on the outcome of a yes/no proposition, such as whether the price of a particular asset—like a stock or a commodity—will rise above or fall below a specified amount.

- Forex Trading: Forex, also known as foreign exchange, FX, or currency trading, is a decentralized global market where all the world’s currencies trade. Quotex offers a platform for Forex trading, allowing traders to speculate on the rising or falling prices of currencies.

- Cryptocurrencies: Quotex trading offers cryptocurrencies such as Bitcoin, Ethereum, Litecoin and others. Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of a central bank.

- Commodities: The broker provides the opportunity to trade in commodities such as gold, silver, oil, and others. Commodities trading involves buying and selling raw or primary products.

- Stocks: Quotex also allows trading in stocks. This involves buying and selling shares in a particular company.

- Indices: Another financial instrument offered by Quotex is indices. Indices trading involves speculating on price movements in a whole index such as the S&P 500 or Dow Jones Industrial Average.

Remember that trading in these financial instruments involves risk and it is possible to lose all your invested capital. Always trade responsibly and only invest what you can afford to lose.

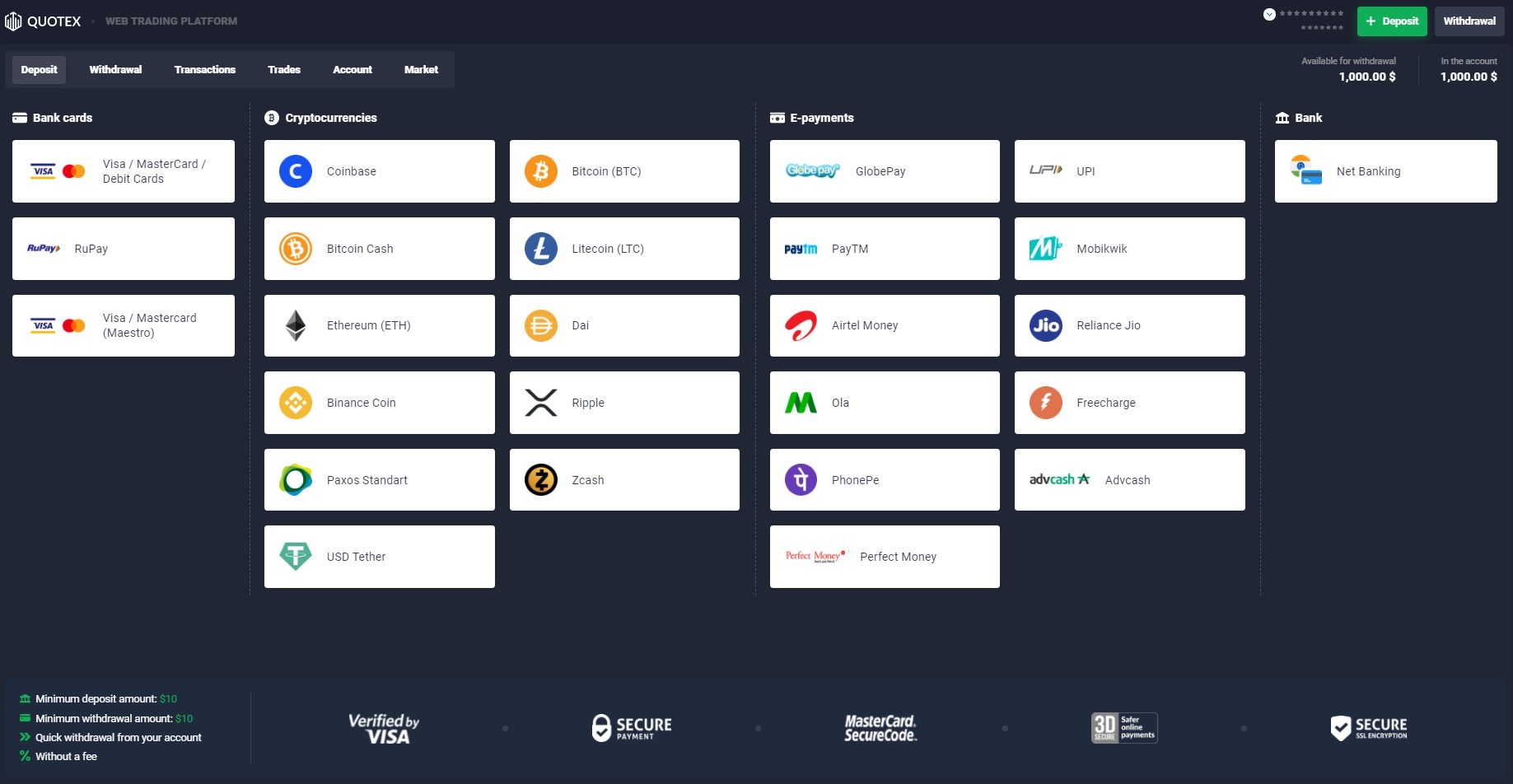

Quotex Deposit Options India

Here are some of the deposit options that Quotex offers for their customers in India:

- Bank Transfer: This is one of the most common methods of depositing money. Users can transfer funds directly from their bank account to their Quotex trading account.

- Credit/Debit Card: Quotex accepts all major credit and debit cards like Visa, MasterCard, and others. This is a quick and easy way to deposit funds into your trading account.

- E-Wallets: Quotex also accepts deposits through various e-wallets like Skrill, Neteller, WebMoney, etc. These platforms are known for their convenience and low transaction fees.

- Cryptocurrency: For those who deal in digital currencies, Quotex accepts deposits in various cryptocurrencies like Bitcoin, Ethereum, Litecoin, and more.

- UPI: Quotex also accepts payments through UPI (Unified Payments Interface), a real-time payment system developed by the National Payments Corporation of India.

- Paytm: Paytm, one of the most popular digital payment platforms in India, is also an available option for depositing funds in Quotex.

Please note that the availability of these deposit options can vary, and it’s always important to check the current deposit methods on the Quotex platform. Also, make sure to be aware of any transaction fees or minimum deposit requirements associated with each deposit option.

Quotex Withdrawal Options India

- Bank Transfer: You can choose to withdraw your funds directly to your bank account. However, this method might incur a small transaction fee and it may take several business days for the funds to reflect in your account.

- Credit/Debit Card: If you’ve funded your Quotex account using a credit or debit card, you can also use it for withdrawals. The transaction time is typically faster compared to bank transfers.

- E-Wallets: Quotex also supports various e-wallets for withdrawals. These include options like Skrill, Neteller, and WebMoney. These platforms usually offer faster transactions compared to traditional banking methods.

- Cryptocurrency: In some cases, you can also opt to withdraw your funds in the form of cryptocurrencies like Bitcoin. This method is fast and secure, but it requires you to have a digital wallet to receive the funds.

Remember, before you can withdraw funds, you need to verify your identity on the platform, which is a standard procedure to prevent fraud and money laundering.

In India, the Quotex minimum withdrawal amount is $10. This means that Indian investors must have at least $10 in their Quotex account before they can process a withdrawal. It is important to note that withdrawal requests are processed within 24 hours and the funds are transferred using the same method that was used for depositing. The platform also does not charge any fees for withdrawals, making it a cost-effective option for traders in India.

Trading Platforms

Quotex is a reputable trading platform that offers a variety of digital trading options for its users. These are delivered through three key platforms:

- Web Version: This is an online-based trading platform that can be accessed through any web browser. Users can directly log onto the website and start trading without needing to download any software. The web version offers a user-friendly interface, real-time charts, and a wide range of trading tools.

- Desktop App: For traders who prefer a standalone application, Quotex offers a desktop app. This platform provides a more robust and comprehensive trading experience. It is designed for both novice and expert traders, providing a wide variety of tools and features to aid in trading decisions. This includes advanced charting tools, multiple technical analysis options, and a customizable trading dashboard.

- Mobile App: This platform allows users to trade from anywhere, anytime using their smartphones or tablets. The mobile app is available for both iOS and Android devices. Like the web and desktop versions, it also offers real-time charts, alerts, and a variety of trading tools.

In summary, Quotex provides a flexible trading environment by offering different platforms to suit the varying needs and preferences of its users. Regardless of the platform used, Quotex ensures a seamless and efficient trading experience. The Quotex download link for pc and mobile is accessed on the broker’s official website.

Is Quotex Legal in India?

Quotex is completely legal in India. Indian traders can freely use Quotex without any restrictions or potential legal issues. This platform offers a wide range of tradable assets, including currency pairs, commodities, and indices. It is regulated and licensed by the International Financial Market Relations Regulation Center (IFMRRC), ensuring its legitimacy and credibility. Hence, Indian users can rest assured about the legal aspect of using Quotex for their trading activities.

Is Quotex safe?

Quotex broker is a secure and reliable platform for online trading in India. This platform strictly adheres to all the regulations and guidelines imposed by the local financial authorities, ensuring the safety and security of its users’ investments and personal information. Quotex uses advanced encryption technology to protect the data and financial transactions of its users from any potential cyber threats. Furthermore, it maintains a high level of transparency in its operations, providing its users with a safe and trustworthy trading environment. Therefore, Quotex is considered safe in India.

Quotex Review India – Conclusion

After conducting extensive research and analysis, it can be concluded that Quotex India has significant potential for growth. The digital platform’s user-friendly interface and high return rates have attracted many Indian investors. However, challenges such as regulatory issues and market volatility pose risks. Therefore, while Quotex presents promising opportunities in the Indian market, it must also strategize to navigate potential challenges effectively.