IQ Option India Review 2026 – Is IQ Option Legal & Allowed in India?

Online trading platforms attract thousands of Indian users every year, and IQ Option is one of the most searched names among them. Many Indian traders want clear answers to questions like “Is IQ Option legal in India?”, “Is IQ Option allowed in India?”, and “Is IQ Option safe for Indian users?”

This in-depth IQ Option India review is written specifically for Indian traders in 2026. It explains how the platform works, what Indian laws say about binary options and offshore brokers, the risks involved, and safer alternatives you should consider before investing real money.

IQ Option is an international online trading platform launched in 2013. It allows users to trade multiple financial instruments from a single interface, including:

-

Binary options

-

Forex (currency pairs)

-

CFDs on stocks, indices, commodities

-

Cryptocurrencies

The platform is popular due to its low minimum deposit, visually rich trading interface, and a free demo account that attracts beginners.

However, popularity does not automatically mean legality or safety, especially for Indian residents. That is why understanding the legal and regulatory context is critical.

IQ Option India Review – Platform Features

Trading Interface & Tools

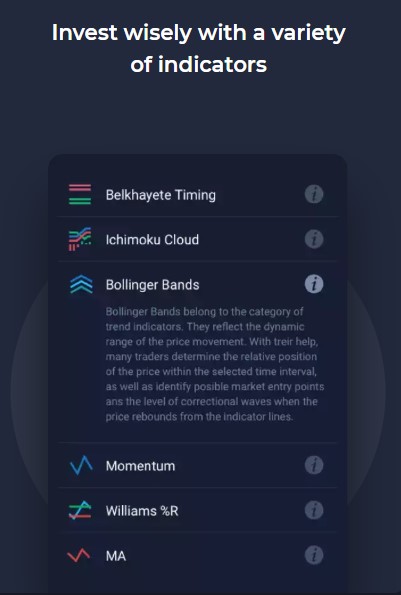

IQ Option is known for its intuitive, chart-heavy interface. Traders get access to:

-

Multiple chart types (candlestick, line, bar)

-

Technical indicators (RSI, MACD, Moving Averages)

-

Time-based and price-based analysis tools

These features are attractive for beginners, but they do not eliminate the risks associated with high-risk instruments like binary options.

Mobile App Experience in India

The IQ Option mobile app is available for Android and iOS. Indian users often search for “IQ Option app India” because:

-

The app is lightweight and fast

-

Trades can be executed quickly

-

Notifications and alerts are built in

Still, ease of use should never be confused with regulatory approval.

IQ OPtion Demo Account for Indian Users

IQ Option provides a free demo account with virtual funds.

This is useful for:

*Important: Demo profits do not reflect real-market conditions or emotional pressure involved in live trading.

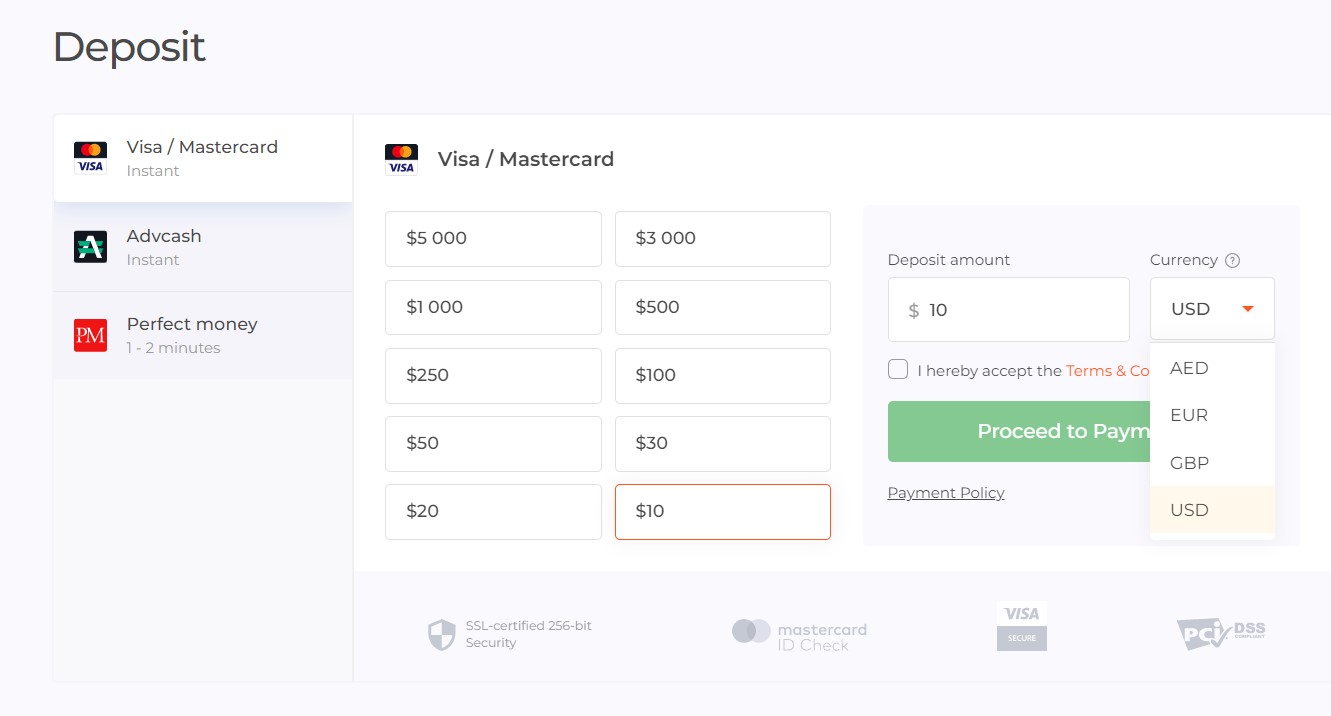

Account Types & Minimum Deposits

Demo Account

-

Free

-

Ideal for beginners

-

Access to virtual funds

Real Account

-

Requires a minimum deposit of $10 (~₹700)

-

Access to all trading instruments

VIP Account

-

For high-volume traders

-

Offers higher profitability rates and personal account manager benefits

Islamic Account

-

Swap-free account for traders following Islamic principles

Tradeable Assets on IQ Option

IQ Option offers a wide range of financial instruments that Indian users can access:

| Asset Class | Examples |

|---|---|

| Binary Options | Short-term directional predictions |

| Forex | Major and minor currency pairs |

| Stocks | Global equities like Apple, Google |

| Cryptocurrencies | Bitcoin, Ethereum, Ripple |

| Commodities | Gold, silver, oil |

| ETFs & Indices | S&P 500, Nasdaq, Dow Jones |

This variety means traders can diversify across assets beyond traditional binary options.

Trading Costs & Fees

Trading Fees

-

Binary and digital options — generally no commission.

-

CFDs — spreads from around 0.005% depending on the asset.

Other Fees

| Fee Type | Details |

|---|---|

| Inactivity Fee | Charged after 90 days of inactivity (~$10) |

| Swap Fees | Applied on some CFD overnight positions (0.01–0.5%) |

| Withdrawal Fees | Second (and further) withdrawals each month may be charged |

Tip:

- Plan withdrawals to avoid unnecessary fees since one per month is free.

Customer Support & Education

Customer Support

IQ Option offers:

-

24/7 multilingual support

-

Live chat and email options

-

Support in multiple languages to accommodate global traders.

Learning Resources

-

Tutorials and webinars

-

Interactive courses

-

Market analysis and blog content

-

Video lessons

These resources help beginners learn trading basics and advanced tactics.

Is IQ Option Legal in India?

IQ Option is not regulated or authorized by Indian regulators such as SEBI or RBI. While Indian residents may technically access the platform, trading on IQ Option operates in a legal grey area and carries regulatory and financial risks.

Is IQ Option Allowed in India?

IQ Option is not officially “allowed” or licensed in India. It does not hold:

-

SEBI registration

-

RBI authorization

-

Any Indian financial services license

This means the platform is not legally recognized for offering trading services in India.

SEBI & RBI Position on Binary Options

In India:

-

Binary options are not recognized as legal financial instruments

-

SEBI regulates stock markets, mutual funds, and derivatives on Indian exchanges

-

Binary options are not traded on any SEBI-approved exchange

As a result, binary options trading platforms operate outside the Indian regulatory framework.

FEMA Rules & Offshore Brokers

The Foreign Exchange Management Act (FEMA) governs cross-border financial transactions in India. Trading with offshore brokers can:

-

Violate FEMA provisions if not compliant

-

Create issues with foreign remittances

-

Expose traders to penalties in extreme cases

While enforcement varies, the risk lies entirely with the trader, not the offshore platform.

Is IQ Option Safe for Indian Users?

Regulation & Licensing Status

IQ Option operates under offshore jurisdictions. It is not regulated by SEBI, FCA (UK), ASIC (Australia), or other top-tier regulators for Indian clients.

This means:

-

No investor protection under Indian law

-

No grievance redressal through the Indian authorities

-

Limited legal recourse if disputes arise

Common Complaints from Indian Traders

Indian users frequently report:

-

Aggressive risk exposure

-

High loss rates in binary options

-

Difficulty resolving disputes

This does not mean every user will face problems, but the risk profile is high.

Fund Safety & Withdrawal Risks

One of the most common complaints from Indian users involves:

-

Delayed withdrawals

-

Account verification issues

-

Sudden account restrictions

Since IQ Option is offshore, Indian courts and regulators cannot intervene easily.

IQ Option Deposits & Withdrawals in India

IQ Option advertises a low minimum deposit, which attracts beginners. However, low entry cost often masks high probability of losses, especially in binary options trading.

IQ Option advertises a low minimum deposit, which attracts beginners. However, low entry cost often masks high probability of losses, especially in binary options trading.

E-Wallets: IQ Option also allows deposits via various e-wallets like Skrill, Neteller, and WebMoney. Indian customers can also use AstroPay Card and AdvCash.

Remember, the IQ Option minimum deposit amount is $10 (USD). It’s also important to know that some banks may charge a small fee for these transactions. Before choosing a deposit method, check the terms and conditions and make sure you’re comfortable with any fees or other requirements. Base currency may not be INR, so currency conversion fees may apply.

Withdrawal Options & Timelines

Withdrawals may be processed via:

-

Bank wire transfer — up to 10 business days

-

Credit/Debit cards — up to 3 business days

-

E-wallets — often within 24 hours

Withdrawal Fees

-

One free withdrawal per calendar month.

-

Subsequent withdrawals may incur a 2% fee.

Important: Withdrawals typically must use the same method as deposit due to anti-money-laundering rules.

Pros and Cons of IQ Option in India

Advantages

-

User-friendly platform

-

Free demo account

-

Multiple asset classes

-

Low minimum deposit

Disadvantages & Risk Factors

-

Not legal or regulated in India

-

Binary options are extremely high risk

-

No SEBI or RBI protection

-

Offshore dispute resolution

-

High probability of capital loss

IQ Option vs Other Brokers for India

IQ Option vs Pocket Option

Both platforms:

-

Are offshore

-

Offer binary options

-

Lack Indian regulation

Neither provides legal certainty for Indian traders.

Check out our detailed comparison of the two brokers here:

IQ Option vs Regulated Brokers

Regulated brokers (Indian stock brokers or international SEBI-compliant alternatives):

-

Offer legal protection

-

Follow disclosure norms

-

Reduce regulatory risk

For long-term traders, regulated platforms are significantly safer.

Best Alternatives to IQ Option in India

Regulated Brokers Accepting Indian Traders

Safer alternatives include:

-

SEBI-registered Indian stock brokers

-

International brokers offering forex or CFDs under recognized regulators

Safer Trading Options for Beginners

Instead of binary options, Indian beginners should consider:

-

Equity investing

-

Mutual funds

-

ETFs

-

SEBI-regulated derivatives

These options offer transparency, legality, and investor protection.

Tips for Indian Traders

✔ Never trade more than you can afford to lose

✔ Use demo trading before live funds

✔ Track trades and maintain a journal

✔ Stay updated with market news

✔ Understand local tax implications of profits

FAQs – IQ Option India

Is binary options trading legal in India?

No. Binary options are not recognized or regulated by SEBI and are considered illegal or unauthorized in India.

Can Indians trade on IQ Option?

Indian residents may technically access IQ Option, but doing so carries legal, financial, and regulatory risks.

Is IQ Option banned in India?

IQ Option is not officially “banned,” but it is not authorized or regulated, which makes it unsafe from a legal perspective.

Can Indian users withdraw money from IQ Option?

Some users report successful withdrawals, but others face delays or restrictions. There is no guaranteed protection.

Is IQ Option safe?

It’s a legitimate platform, but trading risk and lack of strong regulation mean caution is necessary.

Can I withdraw money easily?

Yes, but withdrawal fees may apply after the first free withdrawal each month.

What is the IQ Option minimum deposit?

Minimum deposit is $10 (~₹700).

Why Choose IQ Option in India?

Final Verdict – IQ Option India Review

IQ Option may look attractive due to its interface and low deposit requirements, but Indian traders must look beyond convenience. The platform operates outside Indian regulations, binary options are not legal in India, and traders bear the full risk of losses and legal complications. Understanding how to identify illegal trading platforms can help Indian users avoid costly mistakes.

If you are an Indian trader in 2026, using IQ Option is high-risk and not recommended for long-term or beginner investors. Safer, regulated alternatives provide better protection and peace of mind.

Legal & Risk Disclaimer – India

The information provided on this page is for educational and informational purposes only and should not be considered financial, investment, legal, or trading advice.

Binary options, CFDs, forex, and other leveraged trading instruments are high-risk financial products and may not be regulated or authorized under Indian laws. In India, binary options trading is not recognized or regulated by the Securities and Exchange Board of India (SEBI), and offshore trading platforms such as IQ Option are not licensed or approved by Indian regulatory authorities, including SEBI or the Reserve Bank of India (RBI).

Indian residents who choose to access offshore trading platforms do so at their own risk. Such activities may fall under the Foreign Exchange Management Act (FEMA) and other applicable Indian regulations. The website owner does not guarantee legality, safety, profitability, or account access for users located in India.

Trading involves the risk of substantial financial loss, and most retail traders lose money when trading binary options or leveraged instruments. You should never trade with money you cannot afford to lose.

Before engaging in any form of online trading, users are strongly advised to:

-

Conduct their own independent research

-

Seek advice from a SEBI-registered financial advisor

-

Understand applicable Indian laws and tax implications

This website does not provide personalized investment advice and does not take responsibility for any losses, damages, or legal consequences arising from the use of third-party trading platforms mentioned on this page.