LiteFinance India Review

LiteFinance is a renowned Forex broker that offers its services in India. It is recognized for its easy-to-use platform, competitive spreads, and a wide range of trading instruments. Users have the option to trade in forex, commodities, indices, and shares. The broker provides excellent educational resources and customer support, making it suitable for both beginners and experienced traders. Additionally, LiteFinance forex ensures a secure trading environment with advanced security measures. The broker also offers various account types to cater to different trading styles and investment capacities. It supports all major payment methods for deposits and withdrawals, making it a convenient platform for Indian traders. However, it is essential to thoroughly research and consider the high risk of Forex trading before investing. In this LiteFinance India review, we will learn more about the broker’s advantages, features, and more.

LiteFinance Account Types

- ECN Account: ECN stands for Electronic Communication Network. This type of account is designed for high-volume traders. It offers lower spreads due to direct trade with liquidity providers and a commission is charged per transaction. This account type is suitable for experienced traders who prefer the best possible spreads. The ECN account minimum deposit is $50.

- Classic Account: The Classic account is the standard type of account that most traders tend to start with. It comes with some of the most common features and tools necessary for trading. This account type typically has no commission on trades, slightly higher spreads, and is suitable for beginner and intermediate traders. The Classic account minimum deposit is $50.

- Demo Account: The LiteFinance Demo account is typically used by novice traders who are new to the world of forex trading. This account type allows traders to practice their trading strategies using virtual money, without any risk of losing real money. It is also used by experienced traders to test new strategies before implementing them in the real market.

- Swap-Free Account: This type of account is also known as an Islamic account. It is designed for traders who follow the Islamic faith, which prohibits earning or paying interest. Therefore, these accounts do not incur or earn swaps or interest on overnight positions. A commission may be charged based on the trade size and the type of instrument.

All these accounts offered by LiteFinance India are designed to cater to different types of traders, their trading styles and strategies, as well as their risk tolerance levels. They all come with different features, benefits, and costs, so traders should choose the one that best fits their trading needs.

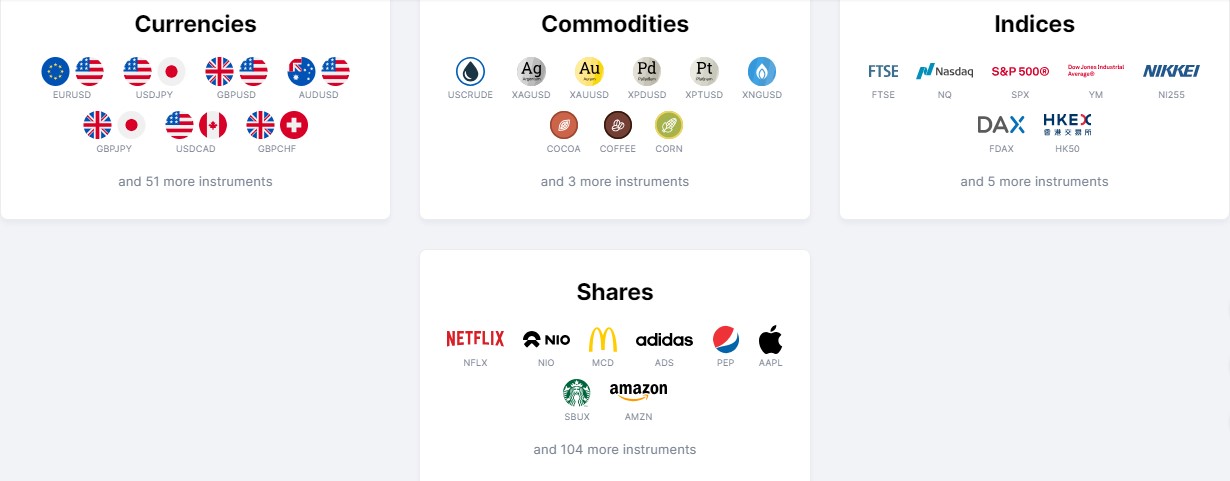

LiteFInance India Review – Trading Assets

Litefinance India offers a wide range of trading assets for investors to diversify their portfolios. This includes:

- Currency: This refers to trading in the forex market where investors can buy and sell different currency pairs based on their value predictions.

- Commodities: This asset class includes physical substances such as gold, silver, oil, and agricultural products. Investors can speculate on the price movements of these commodities.

- Global Stock Indexes: These are indexes that track the performance of a specific group of stocks from a particular country or region. Investors can trade on the overall performance of these indexes.

- CFD NYSE: Contract for Difference (CFD) on New York Stock Exchange listed companies. This allows traders to speculate on the rising or falling prices of fast-moving global financial markets (or instruments) such as shares, indices, commodities, currencies, and treasuries.

- CFD NASDAQ: CFDs on NASDAQ listed companies. This allows investors to trade on the price movements of these stocks without actually owning them.

- CFD EURONEXT: This refers to CFDs on Euronext listed companies, which is a European stock exchange located in Amsterdam, Brussels, London, Lisbon, Dublin, and Paris.

- CFD LONDON LSE: This refers to CFDs on London Stock Exchange listed companies. Investors can speculate on the price movements of these stocks.

- CFD XETRA: This refers to CFDs on XETRA-listed companies. XETRA is an all-electronic trading system based in Frankfurt, Germany.

It’s important to note that trading in CFDs is risky and not suitable for all investors due to the high risk of losing money rapidly due to leverage. It’s advisable to understand how CFDs work and whether you can afford to take the high risk of losing your money before trading.

LiteFinance Deposit Options

- Credit Card Transfers: This option allows you to transfer funds directly from your credit card to your LiteFinance account. This is a convenient method as it is quick and easy and can be done from anywhere at any time.

- Deposit by Bank: With this method, you can deposit funds into your LiteFinance account directly from your bank account. To do this, you would need to visit your bank and request a transfer to your LiteFinance account. This method may take a little longer compared to credit card transfers, but it is equally reliable.

- Electronic Transfers: Electronic transfers, also known as wire transfers, are another method of depositing funds into your LiteFinance account. This process involves transferring money from one bank account to another electronically. It is a safe and secure method of money transfer as it eliminates the risk of losing physical money during the transfer process. This method is ideal for large amounts of money.

These deposit options make it easy and convenient for users in India to fund their LiteFinance accounts. With these methods, users can start trading and investing in the financial markets through LiteFinance. The LiteFinance minimum deposit amount is $50 for all accounts.

LiteFinance Withdrawal Options

- Credit Card Transfers: LiteFinance allows users to withdraw funds directly to their credit cards. This is a convenient option for those who frequently use their credit cards for transactions. The minimum withdrawal amount for credit card transfers is set by the company and it varies depending on the type of credit card and the bank. It is advisable to check with LiteFinance or your bank for the exact details.

- Withdrawal to Bank Account: Another option provided by LiteFinance is the ability to withdraw funds directly to your bank account. This can be done through a simple transfer process, making it easy for users to access their funds. Again, the minimum withdrawal amount for this method is determined by LiteFinance and your bank, so it’s recommended to check with them for precise information.

- Electronic Transfers: LiteFinance also offers electronic transfers. This involves transferring funds electronically to a specified account or digital wallet. With the rise of digital banking, this has become an increasingly popular option. The minimum withdrawal amount for electronic transfers is subject to the policies of LiteFinance and the platform to which the funds are being transferred.

In conclusion, LiteFinance provides various withdrawal options to cater to the needs of its users in India. However, it’s important to note that the LiteFinance minimum withdrawal amount for each of these methods is subject to change and users are advised to verify these details with LiteFinance or their respective banks or platforms.

Trading Platforms

LiteFinance offers a range of trading platforms to accommodate the different needs and preferences of their clients. Here’s a closer look at the trading platforms offered by LiteFinance:

- LiteFinance MetaTrader 4 (LiteFinance MT4): This is a popular trading platform in the forex industry, known for its user-friendly interface and extensive features. It provides advanced charting capabilities, and numerous technical indicators, and supports automated trading systems. It is ideal for both novice and experienced traders.

- LiteFinance MetaTrader 5 (LiteFinance MT5): This is the newer version of MetaTrader and offers more features than MT4. It comes with an integrated economic calendar, a larger number of timeframes, and more technical indicators. It also allows for the trading of stocks and futures, which makes it a more versatile platform.

- cTrader: This is another platform offered by LiteFinance. It is known for its modern, intuitive design and speedy execution of trades. cTrader is favored by many traders for its advanced charting tools and detailed back-testing reports.

- LiteFinance Mobile Apps: For traders who prefer to trade on the go, LiteFinance offers mobile trading apps. These apps are designed to provide a seamless trading experience on mobile devices. They are compatible with both iOS and Android devices and offer all the essential features that you would get on the desktop versions of the trading platforms. With these apps, you can monitor the market, execute trades, and manage your account from anywhere, at any time.

Whether you prefer to trade from your desktop or on the go, LiteFinance broker has a platform to suit your needs. Each platform is designed to provide a high-quality trading experience, with a range of tools and features to assist you in making informed trading decisions.

LiteFinance Forex Trading Tools

- LiteFinance Trading Tools: These are a variety of tools provided by LiteFinance to aid in trading. These tools could include charting systems, indicators, real-time market data, etc. They are designed to help traders make informed decisions by providing them with the necessary data and analytics.

- Economic Calendar: An economic calendar is a schedule of economic events that will take place over the next few days, weeks, or months. This is crucial for traders as these economic events often have a significant impact on the financial markets.

- Analytics: This refers to the systematic computational analysis of data or statistics. In trading, analytics are used to identify patterns and trends in the market, which can help predict future movements.

- Analytical materials from Claws&Horns: Claws&Horns is an independent analytical company providing brokers with a set of necessary analytical tools. These could include forecasts, signals, technical and fundamental analysis, etc.

- Trader’s calculator: This is a tool that helps traders calculate the risk and potential profit of a trade. It can help traders manage their risk and make better trading decisions.

- Fibonacci calculator: This is a tool that calculates the potential support and resistance levels based on the Fibonacci series. This is a popular tool among traders who use technical analysis.

- Currency rates: These refer to the current exchange rates of various currencies. These rates are constantly changing due to supply and demand in the market, and they play a critical role in forex trading.

- Economic news: This is news related to economic events and indicators, such as GDP data, unemployment rates, inflation data, etc. These news events can significantly affect the financial markets and are closely watched by traders.

LiteFinance Copy Trading

LiteFinance Copy Trading is an innovative feature in the financial trading space that allows users to copy the trades of experienced traders. This system enables novice traders to learn and benefit from the strategies and trading decisions of successful traders. With LiteFinance Copy Trading, users can select a trader they want to follow based on their performance and risk profile. They can then allocate a portion of their funds to automatically mimic the selected trader’s actions. This tool is not only beneficial for beginners but also for busy individuals who may not have the time to monitor the market constantly. It allows one to participate in the financial markets with reduced risk and effort.

LiteFinance Platform’s Additional Features

LiteFinance offers several additional services for its users to enhance their experience and make trading more efficient and convenient. Here’s a detailed expansion:

- Autowithdrawal: This service allows you to set up automatic withdrawals from your LiteFinance account. This can be particularly useful if you have a regular amount you wish to withdraw each month, or if you want to ensure that a certain portion of your profits are automatically taken out of your account. This feature can help you manage your finances more effectively, and reduce the risk of leaving too much money in your trading account.

- VPS: VPS stands for Virtual Private Server. LiteFinance forex offers VPS hosting services, which provide users with a stable and secure environment to run their trading platforms and robots 24/7. With a VPS, traders can ensure their trading operations are not disrupted by computer or internet issues, power outages, or other technical problems. A VPS also allows you to trade from anywhere, as you can access your trading platform from any device with an internet connection.

- Forecasts for Quotes: This service provides predictions on future price movements of various financial instruments, based on analysis of historical data and market trends. These forecasts can help traders make more informed decisions when buying or selling assets. By understanding the potential future direction of prices, traders can better plan their trades and potentially increase their chances of making profitable trades. However, it’s important to understand these are only forecasts and not guarantees of future performance. Always use them in conjunction with your own analysis and risk management strategies.

Customer Support

LiteFinance offers a range of customer support options to meet the needs of all its clients. They understand the importance of being available to answer your questions and address your concerns, which is why they provide 24/5 live chat support. This means that you can get real-time assistance from their professional customer service team, any time of the day, any day of the week, excluding weekends.

In addition to this, you can also find them on various social media platforms which allows you to connect with them in a way that’s most convenient for you. Whether you prefer to communicate via Facebook, Twitter, or Instagram, they are always within reach, ready to provide you with the valuable information you need.

For common questions and general inquiries, you can also check their FAQs section on their website. This section is designed to provide instant answers to the most frequently asked questions, saving you time and effort.

If you wish to send them an email, you can do so at clients@litefinance.com. This is especially helpful if you need to provide them with additional information or if your concern requires a more detailed response.

They also offer Skype support through their handle, liteforex.support. This allows for seamless communication where you can discuss your concerns in a more personal and direct manner.

For those who prefer to communicate via Telegram, you can reach them at LiteFinanceSupport. Telegram offers the convenience of instant messaging, making it easy for you to relay your concerns and get immediate answers.

Lastly, if you wish to speak directly with a customer service representative, you can call them at +447520644437. This option is ideal for urgent concerns that need immediate resolution.

Is LiteFinance legal in India?

LiteFinance is a legally recognized financial platform in India. The country’s financial regulatory bodies, such as the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), have allowed the operation of LiteFinance forex in line with the existing financial laws and regulations. LiteFinance adheres to the guidelines prescribed by these authorities, ensuring that all its financial activities are conducted in a fair, transparent, and legally compliant manner. Therefore, it is safe and legal for Indian residents to use LiteFinance broker for their financial needs.

LiteFinance India Review – Conclusion

In conclusion, the review of LiteFinance India indicates a reliable and user-friendly platform for trading and investment services. The platform provides a wide range of financial tools and educational resources that help both novice and seasoned traders enhance their trading skills and strategies. Furthermore, it offers competitive spreads, transparent pricing, and excellent customer service. Despite some minor drawbacks, such as limited accessibility in some regions, LiteFinance India generally receives positive feedback from its users for its high-quality services and robust security measures. Therefore, it is a recommendable choice for those who are seeking a trustworthy and efficient trading platform in India.